Covered calls are a popular options strategy that offers investors a way to generate additional income from their stock holdings while managing risk. For those seeking to enhance returns without taking on excessive risk, covered calls provide a balance between earning premiums and maintaining ownership of the underlying stock. In this blog post, we’ll explore the basics of covered calls, how they work, and why investors might use this strategy.

What is a Covered Call?

A covered call is an options strategy where an investor holds a long position in a stock and simultaneously sells (writes) a call option on the same stock. The key word here is “covered” because the investor owns the underlying stock, which serves as collateral if the call option is exercised.

The strategy works as follows: the investor agrees to sell their stock at a predetermined price (the strike price) to the option buyer if the stock price exceeds that level before the option expires. In return for this potential obligation, the investor receives a premium from selling the option.

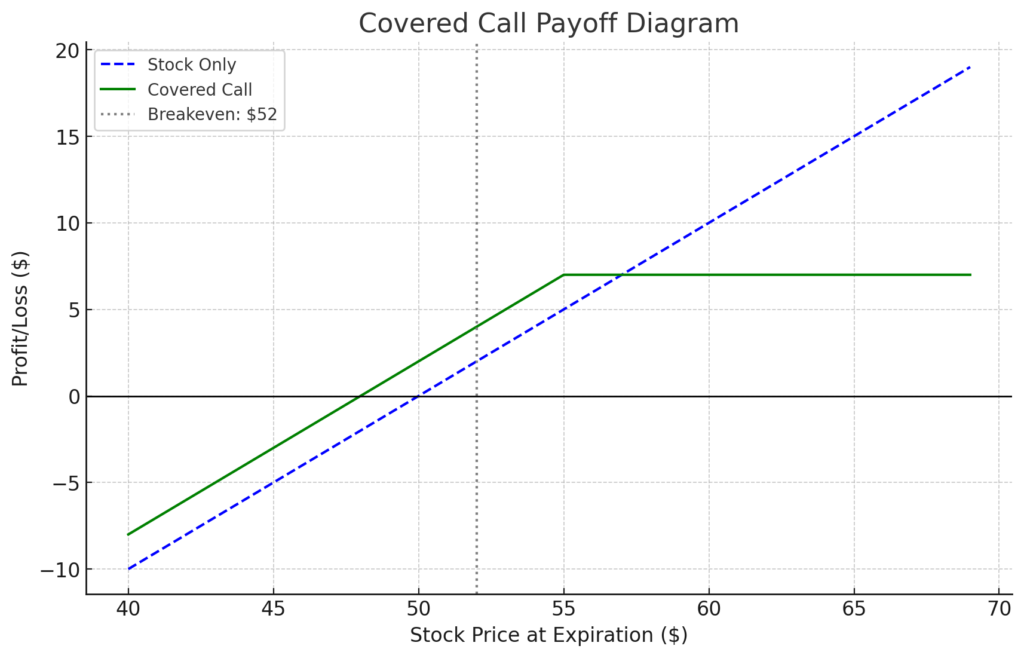

For example, let’s say you own 100 shares of XYZ stock, currently trading at $50 per share. You might sell a call option with a strike price of $55 that expires in one month. The premium you receive for selling this call might be $2 per share, or $200 for the contract (since one option contract typically covers 100 shares).

If the stock stays below $55, the option will expire worthless, and you keep the premium while maintaining ownership of your shares. However, if the stock rises above $55, you’ll be obligated to sell your shares at $55, but you still keep the premium you initially received.

Benefits of Covered Calls

- Income Generation: The primary benefit of covered calls is the additional income from selling the option. This can be particularly useful in a flat or mildly bullish market, where stock prices may not increase significantly. The premium received provides immediate cash flow, effectively boosting the return on the underlying stock.

- Improved Return Potential: By consistently selling covered calls, investors can potentially improve their overall returns compared to simply holding the stock. In a range-bound market, these premiums can add up over time, enhancing portfolio performance.

Risks of Covered Calls

- Limited Upside: One of the main drawbacks of covered calls is that they limit the investor’s upside potential. If the stock price rises significantly above the strike price, the investor is obligated to sell the stock at the lower price, missing out on potential gains.

- Stock Ownership Risk: While the premium provides some protection, covered calls do not offer full downside protection. If the stock price declines sharply, the investor will incur losses on the stock itself, and the premium received may not be sufficient to offset these losses.

- Early Assignment Risk: The option buyer may exercise the call option before expiration if the stock price rises significantly above the strike price. This means the investor could be forced to sell their shares earlier than expected.

When to Use Covered Calls

Covered calls are particularly useful for investors who are neutral to moderately bullish on a stock. If you believe that a stock’s price will remain flat or increase modestly, selling covered calls can generate additional income without adding significant risk.

In summary, covered calls offer an effective way to generate income, making them a valuable tool in an investor’s portfolio. By understanding the trade-offs involved, investors can use this strategy to enhance returns and achieve their financial goals.

This article was written with the express intent for educational purposes only. Any examples used are in no way meant to be investment advice or recommendations. Options are leveraged financial products that entail significant risk. Always consult your financial advisor before taking any investment action.