In the world of options trading, a long put option is a versatile and commonly used strategy, especially when an investor believes the price of an underlying asset is set to decline. Whether used as a form of hedging or speculative trading, the long put can be an effective tool for those aiming to profit from a bearish market.

What is a Long Put Option?

A long put option gives the holder the right, but not the obligation, to sell a specific asset, usually a stock, at a predetermined price (known as the strike price) before or on a specific expiration date. This contrasts with a long call option, which grants the right to buy an asset. Investors buy long put options when they believe the price of the asset will fall, allowing them to sell the stock at a higher strike price even as the market value declines.

How Does a Long Put Work?

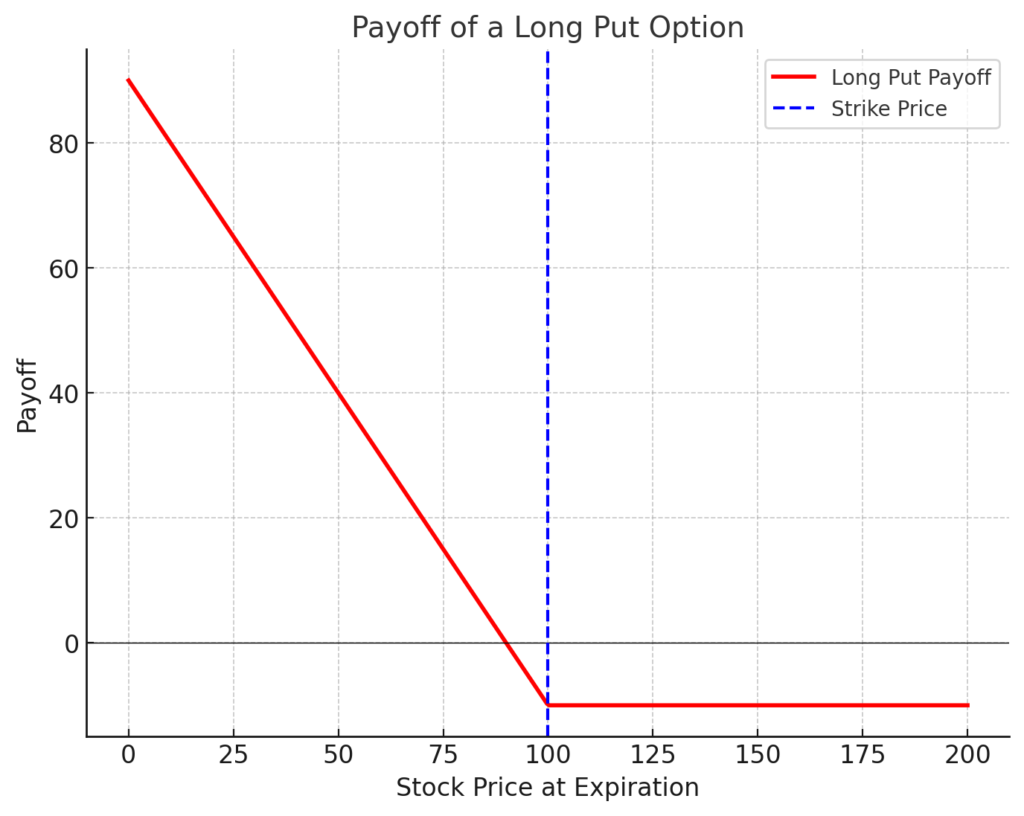

The buyer of a long put option pays a premium upfront to acquire the contract. This premium represents the cost of the option and is the maximum amount the trader stands to lose. If the asset’s price falls below the strike price, the put option increases in value because the holder can sell the asset at the higher strike price. The potential profit is determined by the difference between the strike price and the current market price, minus the premium paid for the option.

For example, if an investor buys a put option on stock XYZ with a strike price of $100 and pays a $5 premium, their break-even point is $95. If the stock drops to $85, the option is worth $15 per share ($100 strike price – $85 market price), yielding a profit of $10 per share after subtracting the $5 premium.

Benefits of Long Put Options

- Profit from Declining Markets: A long put option allows traders to capitalize on falling stock prices. Unlike short selling, which requires borrowing shares and carries unlimited risk, the risk in a long put is limited to the premium paid.

- Defined Risk: The maximum risk for a long put position is the premium paid to purchase the option. This limited risk makes it attractive to traders who want to speculate on price declines without exposing themselves to unlimited losses.

- Hedging: Investors who own stocks may use long puts to hedge their positions. For example, if an investor is worried about a potential market downturn but does not want to sell their stocks, they can buy put options to protect themselves against losses.

Risks and Considerations

- Premium Costs: The premium paid for the option can eat into profits. If the stock does not drop below the strike price before expiration, the option expires worthless, and the trader loses the premium.

- Time Decay: Options lose value as they approach expiration. This “time decay” works against the long put holder. If the stock price doesn’t fall quickly, the value of the put may decrease, even if the stock is trending downward.

- Limited Lifespan: Options have an expiration date, meaning the investor has a limited time for the stock price to move in their favor. If the stock price stays above the strike price until expiration, the option becomes worthless.

Final Thoughts

Long put options are a strategic tool for investors looking to profit from a bearish market or hedge against declining asset values. They offer defined risk and significant profit potential if the market moves as anticipated. However, like all financial instruments, they require careful consideration of the risks involved, such as the cost of premiums and time decay. For investors willing to pay the premium and correctly anticipate market trends, long puts can be an effective addition to their trading strategies.

This article was written with the express intent for educational purposes only. Any examples used are in no way meant to be investment advice or recommendations. Options are leveraged financial products that entail significant risk. Always consult your financial advisor before taking any investment action.