A long call option is one of the most widely used strategies in options trading by retail traders, offering traders a way to capitalize on rising markets with limited risk. Whether used for speculation or hedging, long call options allow investors to profit from bullish market movements without having to buy the underlying asset outright.

What is a Long Call Option?

A long call option gives the holder the right, but not the obligation, to buy a specific underlying asset, usually a stock, at a predetermined price (the strike price) before or on a specific expiration date. Investors purchase long call options when they believe the price of the asset will rise. The advantage of this strategy is that the investor can benefit from the stock’s upside potential without actually owning the stock and committing a large amount of capital.

How Does a Long Call Work?

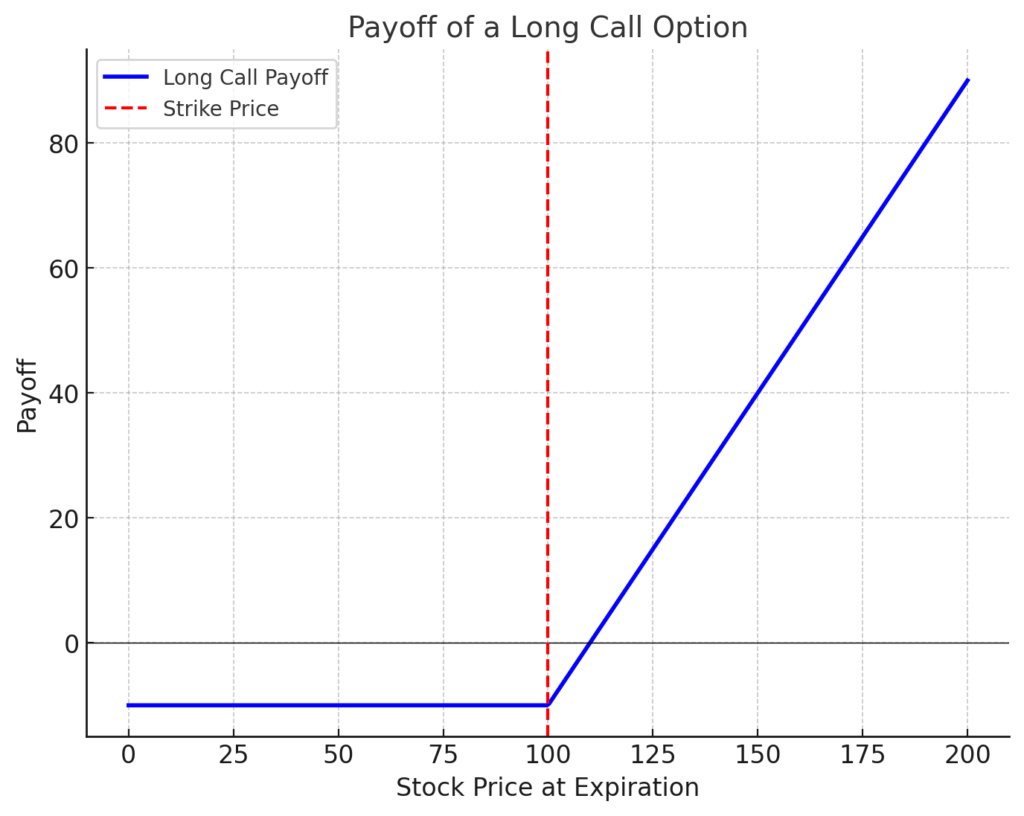

When an investor buys a call option, they pay a premium, which represents the cost of the option. This premium is the maximum amount the investor can lose, making the risk of a long call limited. If the underlying asset’s price rises above the strike price, the call option gains value because the holder can buy the asset at the lower strike price and sell it at the current higher market price.

Imagine you think Company X’s stock, currently priced at $85, will go up. You buy a call option with a strike price of $100, which gives you the right to buy the stock at $100 anytime in the next month. You pay a $5 premium for this option.

Two things could happen:

- Stock Price Rises: If the stock rises to $120, your call option becomes valuable. You can buy the stock for $100 (exercising the contract), even though it’s worth $120. Your profit would be $20 per share ($120 – $100), minus the $5 premium you paid. So your net gain would be $15 per share.

- Stock Price Falls or Stays the Same: If the stock stays below $100, it wouldn’t make sense to exercise your option because you could buy the stock cheaper on the open market. In this case, you let the option expire, losing only the $5 premium.

Benefits of Long Call Options

- Leverage with Limited Risk: One of the primary advantages of a long call option is leverage. Instead of purchasing the stock outright, which requires a significant capital outlay, the investor only pays a premium for the option. This allows the investor to control the same number of shares with a much smaller investment. The maximum risk is the premium paid, while the potential upside is theoretically unlimited.

- Profit from Rising Markets: A long call option is ideal for traders who believe the price of the underlying asset will rise. As the stock price increases above the strike price, the value of the option grows, offering substantial profit potential.

- Defined Risk: Unlike buying the stock directly, where the value of the investment can decrease if the stock price drops, a long call option has a defined risk. The most the investor can lose is the premium paid for the option, regardless of how far the stock price falls.

Risks and Considerations

- Premium Costs: The premium paid for the call option is an upfront cost that the investor must recoup through the stock’s price appreciation. If the stock does not rise above the break-even point (strike price + premium) before expiration, the investor will lose the entire premium paid.

- Time Decay: Options lose value as they approach expiration, a phenomenon known as time decay. This means that the value of the call option can erode over time if the stock does not move significantly in the investor’s favor. The closer the option is to its expiration date, the faster the time decay impacts the option’s value.

- Expiration Risk: Call options have a limited lifespan. If the stock does not rise above the strike price before the expiration date, the option will expire worthless. This creates a race against time for the investor, as they need the stock to move in their favor within the specified timeframe.

Final Thoughts

Long call options are a powerful tool for traders who are bullish on a stock or market and want to leverage their investment with defined risk. By paying a premium, investors can potentially profit from rising stock prices without needing to purchase the underlying asset. However, like all options strategies, long calls come with risks, including the cost of premiums, time decay, and expiration. For those who anticipate a strong upward movement in the market, long call options can offer substantial rewards, but careful analysis and timing are essential for success.

This article was written with the express intent for educational purposes only. Any examples used are in no way meant to be investment advice or recommendations. Options are leveraged financial products that entail significant risk. Always consult your financial advisor before taking any investment action.